How do we ensure cross-border payments through banks and other financial institutions are safe, transparent, fast, low-cost, and inclusive?

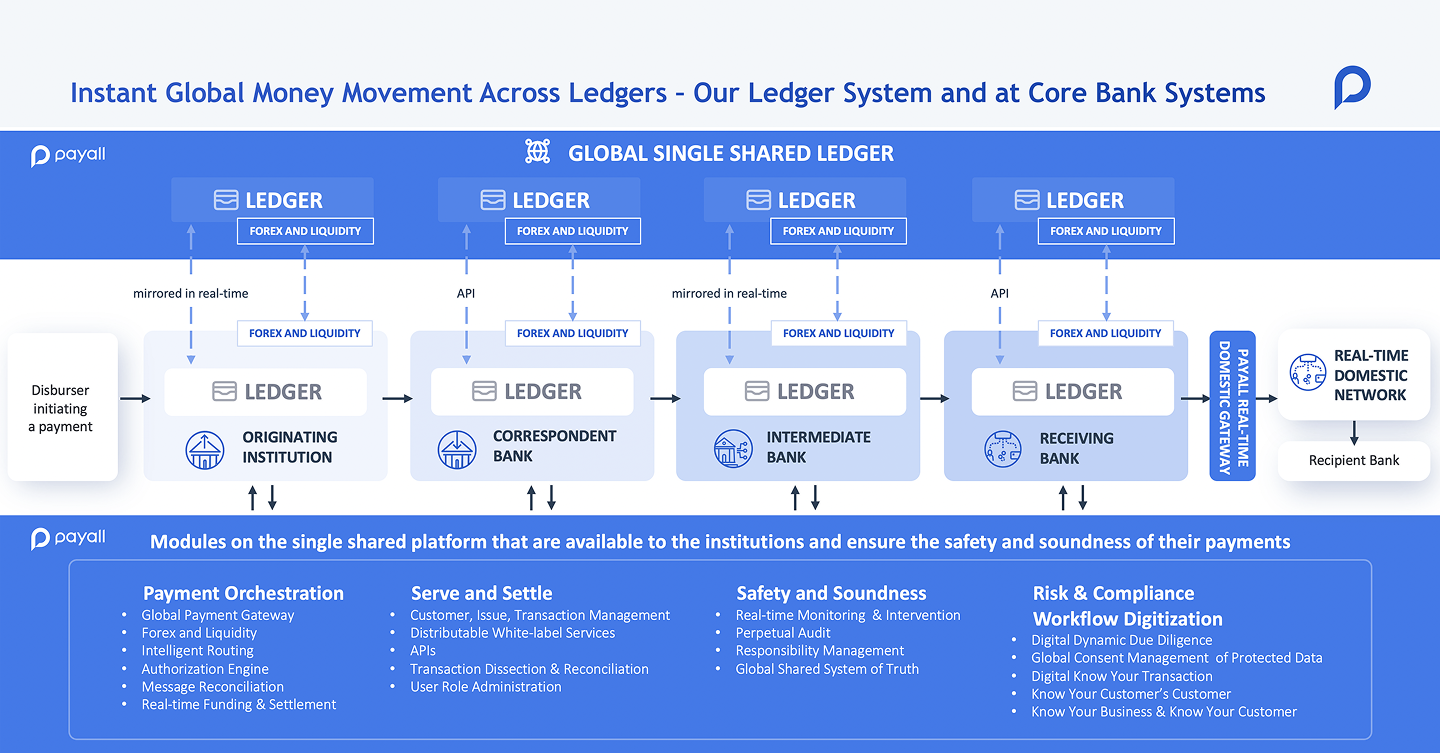

Payall’s architecture is akin to the ECB & U.S. Fed: a single shared platform for settlement between banks. But ours is the first global, multi-currency single shared platform with a suite of purpose-built capabilities that make cross-border payments safe, transparent, instant, low-cost & inclusive through banks and other financial institutions.

We met with correspondent banks, originating institutions, regulators, central banks, and liquidity providers and learned their pain points. With this, we re-imagined cross-border payments from the first principles. The result: something that doesn’t exist in any core system, digital bank, fintech, central bank or regulator tech stack:

We enable real-time ledgering as a system of record where desired and instantly connect a disconnected web of core bank systems and FX and liquidity providers. This eliminates FX risk and settlement delays of transactions being manually posted during business hours.

We digitize countless risk, compliance, SOPs, and other tasks/rules performed by humans across multiple institutions eliminating up to 98% of the time and costs while ensuring 100% process execution.

We deliver real-time, 100% transparency to every rule across the ecosystem including the results, supporting artifacts and consent-managed data sharing on every cross-border transaction.

Our global payment gateway is directly connected to domestic RTP networks, delivering funds instantly, 24/7.

BTW, since this is fiat, not a new asset class or digital currency and money moves the same familiar/trusted way it’s moved domestically & globally for 50+ years (debits & credits across bank ledgers); and there are no new counter-parties adding risks & costly oversight - banks aren't treading into unchartered regulatory, legal or tech waters with unforeseeable & unknowable risks.

We fix what's broken across the correspondent banking ecosystem:

Ineffective & inefficient counter-party risk management,

Multi-jurisdictional compliance challenges,

Transaction risk,

No see-through,

Risky data handling & storage,

Human KYT/KYCC & countless other complex workflows,

Business day funds movement across time zones & currencies & ledgers, payment orchestration & more)

with tech perfect for the job.

While we’re faster and greener than blockchain or stablecoins, we’re neutral on currency and support stablecoins and any payment form factor. In fact, we help stablecoin players & banks that serve them with end-to-end counterparty risk management, fiat in/out payment orchestration & compliance.

We never compete with banks, other types of financial institutions, or regulated entities — we empower them. Our enterprise-grade infrastructure is endorsed by smart & big-idea investors such as a16z, Ventura Capital, Motivate Ventures, Thomson Reuters, Sumitomo Corp/Presidio, PS27, RRE & others.

For more insights, follow Gary Palmer and Payall on LinkedIn. And if you’re curious to learn how Payall can help you, drop us a message and we’ll get back to you shortly!